Zaggle Prepaid Ocean Services Business analysis

Contents

Business

Industry overview

Operating metrics

Financials

Points to consider

Valuation

Business

Zaggle Prepaid Ocean Services, started in 2010, based out of Mumbai provides a combination of payment instruments as well as an integrated mobile application that digitises business and employee spends through their SaaS platform .

Zaggle Prepaid is a leading player in spend management, with more than 5 crore prepaid cards issued in partnership with banking partners and more than 22.7 lakh users served.

Zaggle Prepaid offers an ecosystem-based approach across SaaS and fintech, with low customer acquisition and retention costs in the B2B segment. They base their strategy on cross-selling, up-selling to existing customers.Through partnerships with banks and fintechs, Zaggle Prepaid offers customers' employees, channel partners and consumers SaaS and fintech solutions.

Zaggle Prepaid has served brands such as Tata Steel, Persistent Systems, Inox, Wockhardt, Mazda, RP – Sanjiv Goenka Group, Hiranandani group, Greenply Industries.

Product segments

SaaS offerings ( Propel, Save, CEMS and Zoyer) for businesses includes business and employee spend management, employee benefits management, employee incentives, channel rewards and incentives, employee rewards and recognition and employee tax benefits.

Propel

A corporate SaaS platform for channel rewards and incentives, employee rewards and recognition

Save

SaaS-based platform and mobile application to offer expense management solution for business spend management ( digitized employee reimbursements and tax benefits )

CEMS

Customer engagement management system that enables merchants to comprehensively manage their customer experiences including rewarding merchants through gift card and loyalty benefits

Zaggle Payroll Card

Prepaid payroll card that allows customers to pay contractors, consultants, seasonal and temporary employees and unbanked wage workers as an alternative to direct deposits to bank accounts or cash payments

Zoyer

An integrated data driven, SaaS based business spend management platform with embedded automated finance capabilities in core invoice to pay workflows.

Zaggle Prepaid has 1,832 corporate accounts and 579 SMB accounts.

The mobile application provides customers and users with a real time view of card details, account balance, transactions, card security, easy expense management by allowing for bills to be uploaded, approved, and paid for corporate spending. The platform can be used for setting spending limits for employees according to their role and designation, prohibit designated spends (for alcohol), transactions at non-designated merchant establishments-overall helps corporates manage their employee spending on perks given.

Industry overview

Fintech players in India are increasingly focusing on the employee-oriented services market as this segment of customers is easy to acquire and retain at lower costs.

The overall market for spend management software and services (in-house and outsourced; including procurement management, expense management, and payroll management) was estimated to be Rs 8200cr (FY22), expected to cross Rs 20000cr by FY27, with the share of outsourced spend management estimated to be around 60%

Breakup of the total spends management industry -

Payroll management 60%

Customer engagement 19%

Vendor payment 12%

Employee engagement 9%

Growth drivers

Usual corporate travel/ other expense reimbursement cycle is 7- 35 days, where in most cases, reimbursements are made post submission of bills and processing them. Firms like Zaggle Prepaid target this for reduction of payment cycle and enabling easier liquidity management to employees.

Competitors offering similar SaaS solutions are Coupa, Expensify, Edenred and Wex

Points to consider

Prepaid industry among fintech projected growth is very high, and company is solving an customer problem of expense management software and reducing employee reimbursement cycle.

Customer acquisition cost is increasing for Zaggle over the years, plus they intend to use 300cr of IPO proceeds for customer acquisition & engagement. Spending the amount for additional customer acquisition or but addition of more cashback amount to end users or customers ( employers) is not clear.

75% reserved for QIB, 294cr, out of which 252 cr already raised from anchor investors gives a signal that professionals are interested in the business.

Network effects at play may come up after a point of time as corporates usually follow each other in terms of adopting emerging trends.

Valuation

Zaggle Prepaid is valued at P/E of 87

No comparable listed peers

You may be interested in

How to do IPO analysis for listing gain

How to avoid companies like Brightcom/ BCG ? Investing red flags

Will Jio Financial disrupt Bajaj Finance

RR Kabel IPO Analysis

Follow us on twitter

#themoatinvestor #dmoatinvestor #zaggleprepaidipo #listinggain

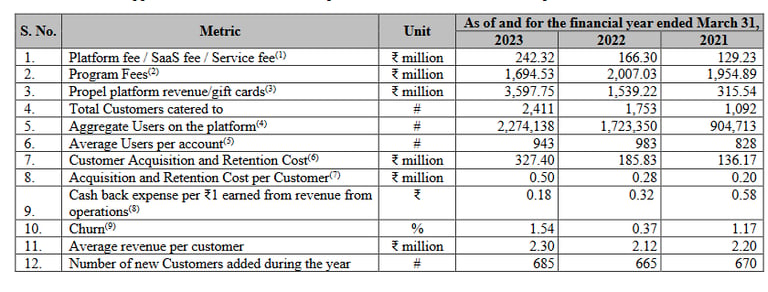

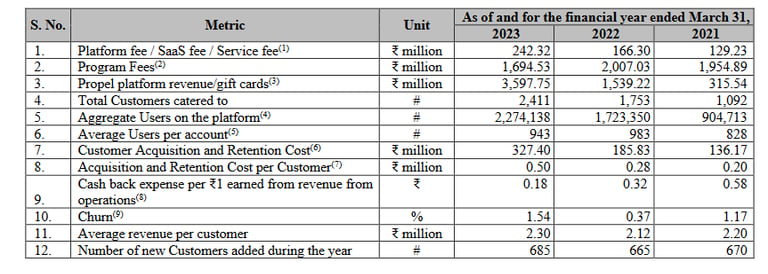

Operating metrics

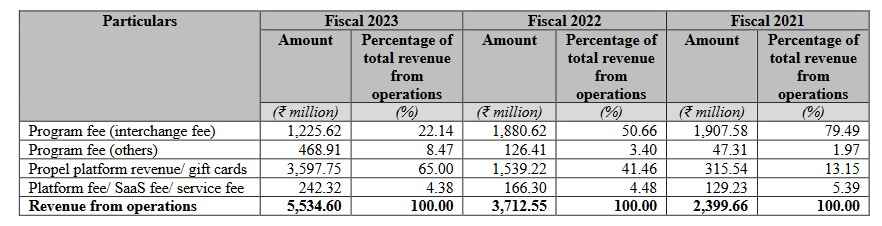

Platform fee / SaaS fee / Service fee refers to all fee income received by Zaggle from the customers( fixed monthly subscription fees paid on a per user basis and any one-time setup fees)

Program fees refers to the sum of interchange fees earned on the spend that customers 'employees and channel partners make on the cards and excludes amounts collected on behalf of its Preferred Banking Partners and any other income which the Company receives from its Preferred Banking Partners and third-party Payment Networks such as Visa and inactivity fees which is earned on the balance amount left on the cards.

Propel platform revenue/gift cards refers to revenue which is received from customers for issuing reward points to customers’ employees and channel partners.

Total cards issued are more than 5cr. Total user 22.74 lakh. Total customers ( companies) enrolled are 2411. ( FY 21 1092)

Though number of users more than doubled in 2 years, program fees have reduced.

Existing customers constitute 70% of revenues, new customers 30%, indicating god amount of reselling upselling as company intends to do.

Zaggle Prepaid has 6% market share of total expense/payroll/procurement management transactions revenues, and 16% in terms of total issued prepaid cards.

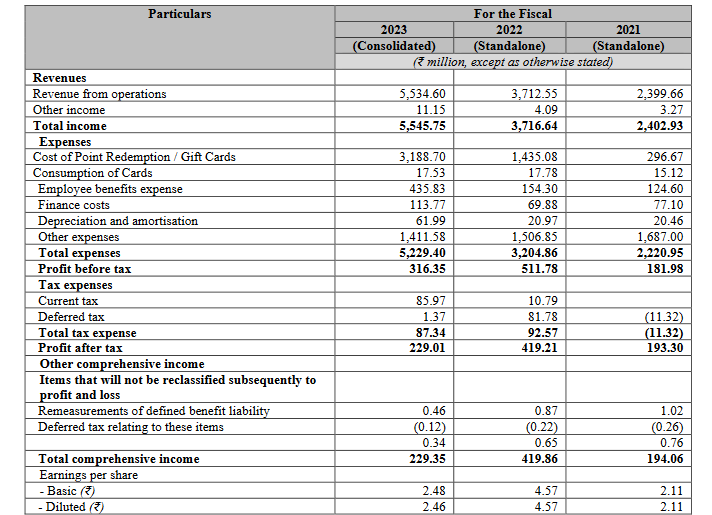

Financials

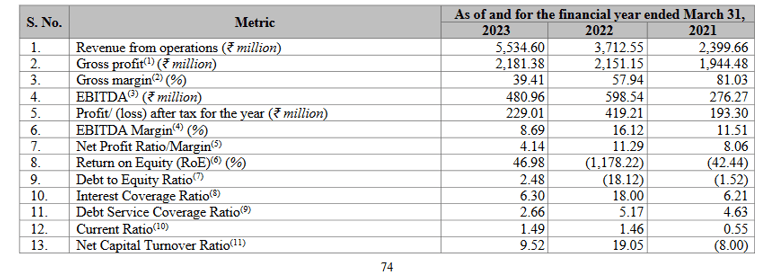

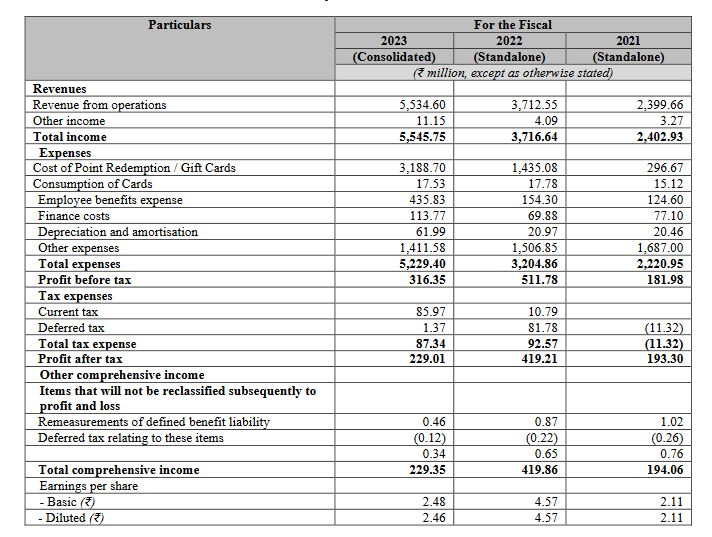

Annual revenues of Zaggle is 550cr. PAT 23cr.

Revenues increased at CAGR of 52% and PAT increased from 19cr to 22 cr.

Point to note is the shift in revenue mix- program fee which formed 80% of revenues in FY21 is now 22%, propel platform revenues/ gift cards now form 65% of revenues, which is a good sign as program fees are dependent on banking partner tie-ups which may dwindle.

EBITDA margins 8.7% ( margins are decreasing though customer base has doubled)

PAT margins 4.1%

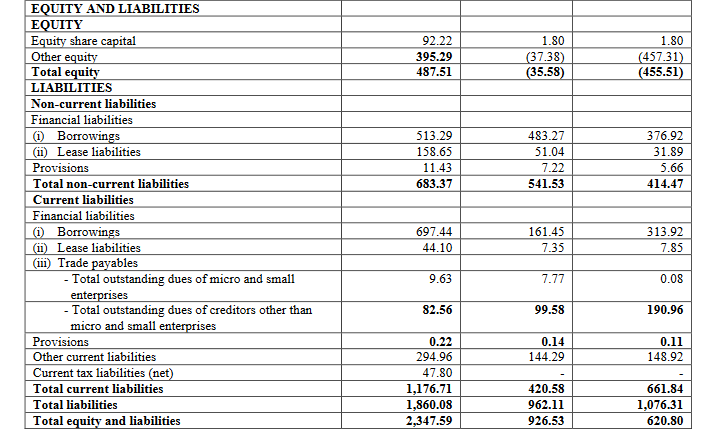

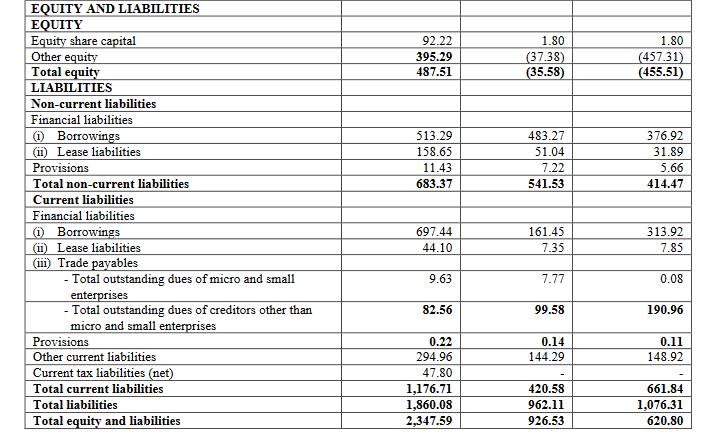

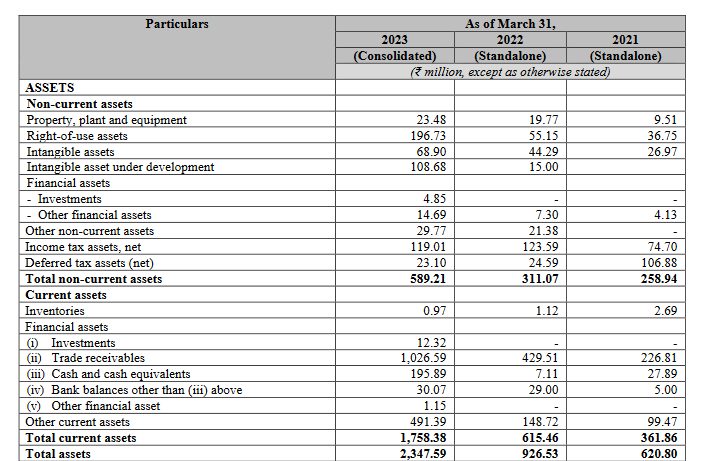

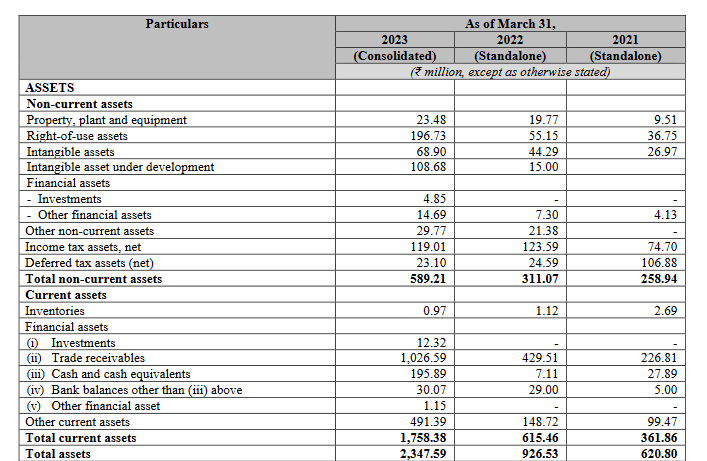

Balance sheet ( amount above in Rs millions)

Borrowing at 120cr

Current debt/ equity ratio at 2.48

Trade receivables 103 cr.

Cash equivalent of 19 cr.

Cashflow from operations negative in FY23, was positive in last 2 years.